Unknown Facts About Amur Capital Management Corporation

Unknown Facts About Amur Capital Management Corporation

Blog Article

About Amur Capital Management Corporation

Table of ContentsThe Amur Capital Management Corporation StatementsThe Definitive Guide to Amur Capital Management CorporationAmur Capital Management Corporation for DummiesMore About Amur Capital Management CorporationAmur Capital Management Corporation Things To Know Before You BuySome Known Details About Amur Capital Management Corporation Indicators on Amur Capital Management Corporation You Need To Know

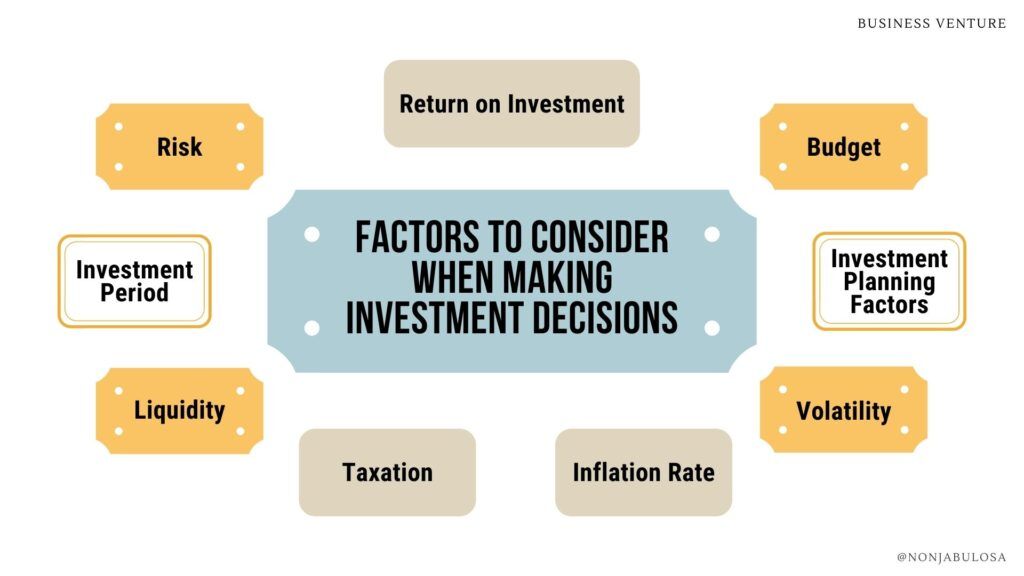

The timeless parlor game Othello lugs the tagline "A minute to find out ... a life time to master." That single sentence could put on the task of picking your financial investments. Understanding the fundamentals doesn't take long, but mastering the nuances can take a lifetime. Here are some fundamental concepts any kind of financier must understand if they intend to improve the effectiveness of their financial investment option.Provide your money time to expand and compound. Identify your danger tolerance, after that choose the types of investments that match it.

Rumored Buzz on Amur Capital Management Corporation

You need to devote to a time period throughout which you will leave those investments untouched. A sensible rate of return can be expected just with a long-term horizon. When financial investments have a very long time to appreciate, they're much more likely to weather the inevitable ups and downs of the equities market.

Another important reason to leave your financial investments untouched for numerous years is to take benefit of compounding. When you begin gaining money on the cash your financial investments have actually already made, you're experiencing compound growth.

The Single Strategy To Use For Amur Capital Management Corporation

They get the benefit of intensifying development over a longer duration of time. Property allocation indicates placing your investment funding right into numerous types of investments, each standing for a portion of the entire. Alloting properties into different classes that are not very correlated in their rate activity can be an extremely efficient method of diversifying threat.

, or worldwide stocks. If short-lived losses maintain you awake at evening, concentrate on lower-risk choices like bonds.

Amur Capital Management Corporation Can Be Fun For Everyone

Nobel Champion economist Harry Markowitz described this benefit as "the only free lunch in finance - https://www.reddit.com/user/amurcapitalmc/. capital management." You will certainly earn a lot more if you expand your profile. Here's an instance of what Markowitz meant: An investment of $100 in the S&P 500 in 1970 would certainly have expanded to $7,771 by the close of 2013

Currently, picture you adopt both techniques. If you had invested $50 in the S&P 500 and the other $50 in the S&P GSCI, your total investment would certainly have expanded to $9,457 over the exact same duration. This suggests your return would certainly have exceeded the S&P 500-only profile by 20% and be practically double that of the S&P GSCI efficiency.

7 Simple Techniques For Amur Capital Management Corporation

Whatever else takes extremely specialized understanding. If most capitalists can reach their objectives with a mix of stocks and bonds, after that the supreme concern is, exactly how much of each course should they choose?

The truth is, the overall return on stocks historically has been much greater than for all various other possession courses. In his publication Stocks for the Future, author Jeremy Siegel makes a powerful instance for making a profile being composed mostly of supplies. His reasoning: "Over the 210 years I have analyzed stock returns, the genuine return on a broadly diversified portfolio of stocks has averaged 6. investment.6% annually," Siegel claims

The Buzz on Amur Capital Management Corporation

"At the end of 2012, the yield on nominal bonds was read this article around 2%," Siegel notes. "The only way that bonds could generate a 7.8% actual return is if the consumer price index fell by almost 6% per year over the next 30 years.

Instance in point: At a rate of 3% inflation annually, $100,000 will be worth just $40,000 in three decades. Your age is as relevant as your character. As you obtain closer to retired life, you must take fewer risks that can jeopardize your account balance just when you require it.

The Buzz on Amur Capital Management Corporation

In maintaining with the Pareto Concept, we'll think about the five most essential elements. The regularity and amount of the reward are subject to the business's discretion and they are mostly driven by the business's monetary efficiency.

Report this page